TWS Headset Market Analysis

First, the TWS headset market is developing rapidly

With the continuous evolution of the appearance and functions of smartphones, some manufacturers continue to omit some traditional mobile phone functions in order to make the phone lighter and thinner, such as canceling the 3.5mm headphone jack, but consumers report that they need to use an adapter cable to transfer the headset Plug in the charging interface to listen to songs, and you can't charge while listening to songs. As a result, wireless headsets have become more and more popular in the market.

1.1 Wireless Bluetooth headset is expected to become the mainstream of the market

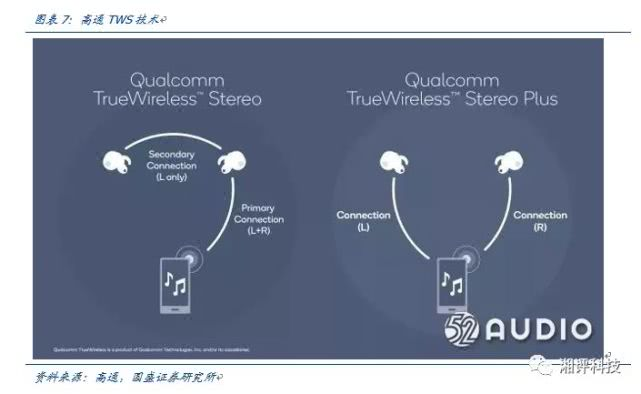

The wireless Bluetooth headset actually appeared as early as ten years ago in the Nokia era, but with the release of Apple's Airpods, the wireless Bluetooth headset market has reached a climax. First of all, by definition, TWS is the abbreviation of True Wireless Stereo, which means true wireless stereo. TWS earphones do not have traditional physical wires. The left and right earphones form a stereo system through Bluetooth. A mobile phone can be connected to a receiving section. This receiver will give the stereo to the other receiver wirelessly to form stereo.

Because the left and right units of the TWS headset have no physical connection, Bluetooth headsets are generally not charged through the microUSB interface. Therefore, almost all TWS headsets are equipped with a carrying case that has both charging and storage functions, and some carrying cases also integrate a mobile power supply inside. When you run out of power, just put the headset in the box and automatically disconnect it to recharge.

However, many TWS Bluetooth headsets currently on the market are relatively expensive due to their high cost. The price of Apple AirPods is about 1276 yuan, and the price of Sony noise reduction beans reaches 1599 yuan. In comparison, the price of domestic TWS headsets is more advantageous. Meizu pop is at 499 yuan, PaMu headsets are 349 yuan, and Xiaomi's Bluetooth wireless headset Air is priced at 399 yuan.

So why can wireless Bluetooth headsets quickly explode the market? Compared with traditional headsets, TWS wireless headsets have the following advantages:

| Adopting wireless structure design, abandoning wired troubles, making sports and carrying more convenient.

| Realize wireless stereo, improve sound quality, and stabilize the connection.

| Endurance has been improved.

| The headset uses multiple sensors, artificial intelligence assistants and a convenient entrance for smart homes.

| It can be used in various ways, it can be used alone or shared.

According to GFK data, in 2016, wireless headset shipments were only 9.18 million units, and the market size was less than 2 billion yuan. GFK expects that wireless headset shipments in 2018 will increase by 41% year-on-year, and the market will reach 5.4 billion US dollars. By 2020, the market size of TWS wireless headsets will reach US$11 billion. It is expected that as the sound quality and functionality of wireless headsets continue to improve, the penetration rate of wireless headsets is expected to continue to increase in the future.

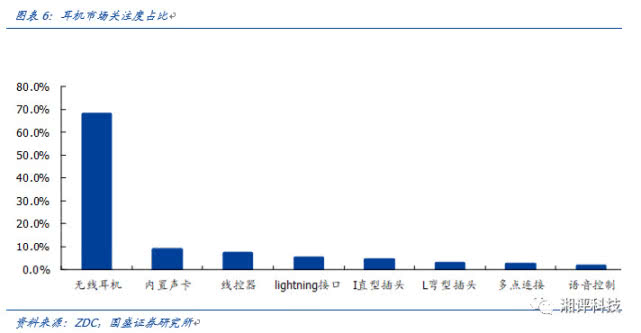

According to data from ZDC, the current market’s attention to wireless headsets is as high as 68%, which is much higher than other functions.

1.2 Bluetooth 5.0 technology promotes the rise of the industry

I believe that most consumers will not feel unfamiliar with this feature of Bluetooth. In the past, mobile phones only relied on Bluetooth to transfer files. Later, various Bluetooth devices appeared, such as Bluetooth headsets, Bluetooth mice, and Bluetooth keyboards. With the emergence of smart bracelet smart watches, the current Bluetooth version has already come to version 5.0.

In fact, as early as 2016, the Bluetooth Technology Alliance proposed a new Bluetooth technology standard-Bluetooth 5.0.

| Bluetooth 5.0 is mainly aimed at low-power devices, with wider coverage and a four-fold increase in speed compared to the current one.

| Bluetooth 5.0 also adds an indoor positioning assist function, combined with Wi-Fi can achieve indoor positioning with an accuracy of less than 1 meter.

| The upper limit of the transmission speed of Bluetooth 5.0 is 24Mbps, which is twice that of the previous 4.2LE version, and the transmission level has reached a lossless level.

| The effective working distance of Bluetooth 5.0 can reach 300 meters, which is 4 times that of the previous 4.2LE version.

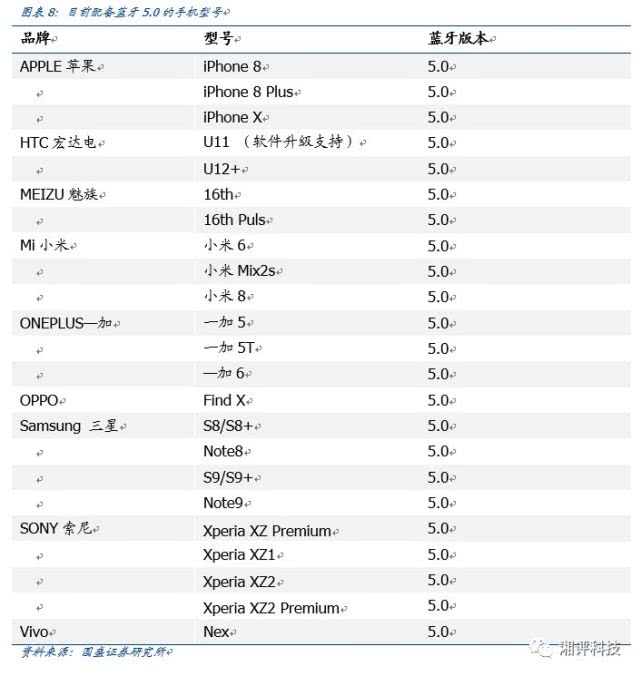

The high transmission bandwidth of Bluetooth 5.0 also makes it possible to make bilateral calls with TWS true wireless Bluetooth headsets. At present, the main models of Bluetooth 5.0 mobile phones on the market are as follows:

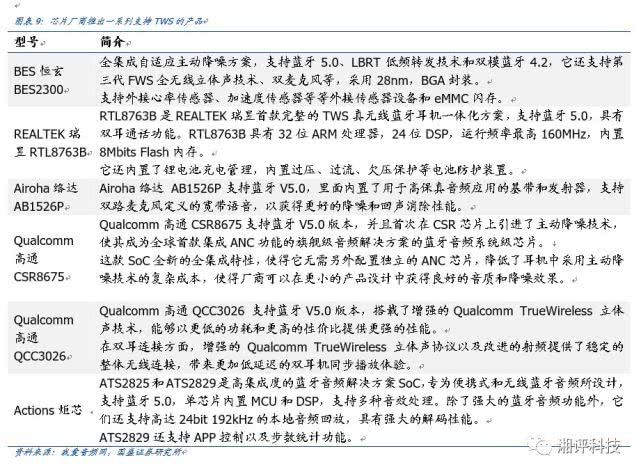

In addition, major chip manufacturers have also followed the trend of TWS wireless headsets and launched a series of products that support TWS wireless Bluetooth headsets. With the popularization of Bluetooth 5.0 technology, the growth momentum of wireless Bluetooth headsets is good, and explosive growth is expected in the next few years.

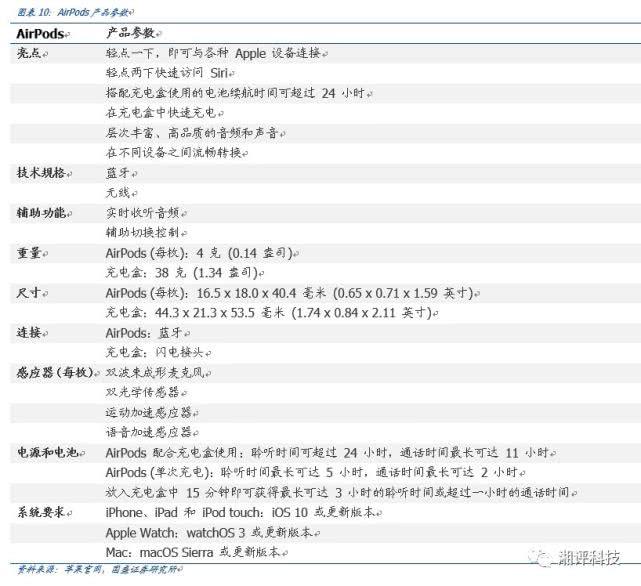

1.3 AirPods: Leading the trend of wireless headphones

Apple AirPods is a wireless headset of Apple, which was released together with iPhone 7 at the 2016 Apple Autumn New Product Launch Conference on September 8, Beijing time. The built-in infrared sensor of the headset can automatically recognize whether the headset is automatically played in the ear. The battery life is up to 5 hours. When the headset is worn, it will automatically play music. Double-click the headset to turn on Siri. The charging box supports 24 hours of battery life. auto recognition.

AirPods are equipped with a custom Apple W1 chip that uses optical sensors and motion acceleration sensors to detect whether the user has worn them in the ear. Whether using AirPods with both ears at the same time, or wearing only one of them, the W1 chip can automatically transmit audio and activate the microphone. When the user is on the phone or talking with Siri, the additional acceleration sensor works in harmony with the microphone using beamforming technology to filter out background noise and clearly lock the user's voice. Because the low-power W1 chip manages the battery life very well, the AirPods can listen for up to 5 hours with a single charge, which is outstanding. As the charging box provides additional multiple charges, this headset can meet more than 24 hours of power usage. For fast charging, just put it in the charging case for 15 minutes to get up to 3 hours of use.

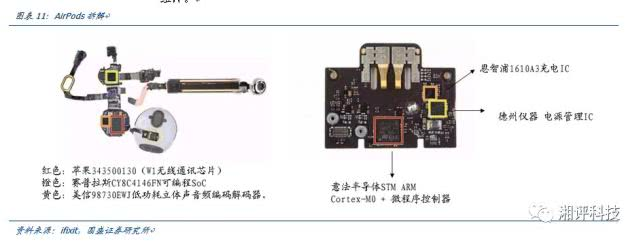

According to the disassembly of the ifixit website, the earbuds of the AirPods headset includes a single-sided circuit board (PCB), a double-sided PCB, and a small hose extending to the bottom of the Airpods. On a single-sided PCB, we can see the W1 SoC, a Cypress SoC, STMicroelectronics' low-dropout (LDO) regulator, and some other components.

In the double-sided PCB, we found a Maxim audio codec and a Bosch BMA280 accelerometer on one side. On the other side, we found an ultra-low power 3-axis accelerometer from STMicroelectronics, an LDO regulator from STMicroelectronics, as well as an unrecognizable light sensor and some passive components.

In the hose and battery assembly at the end of each Airpods, we saw a MEMS microphone assembly from Goertek.

The design and chip count of each Airpods are the same. The main IC components and their quantities inside the two earplugs and the charging box are shown in the following table:

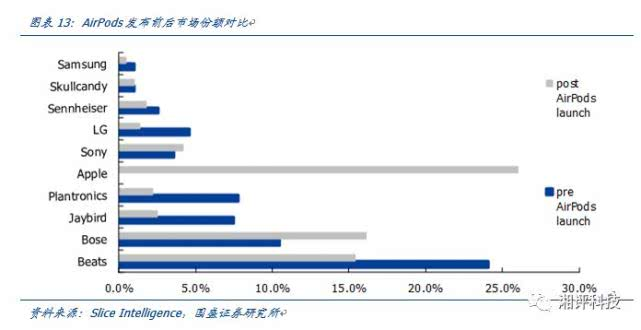

AirPods has become the most popular wireless headset in the United States in just one month. According to data from the market research agency Slice Intelligence, it has occupied 26% of the market share in just one month, surpassing Beats and Bose headsets.

We expect shipments of 2018E/2019E/2020E AirPods to be 0.26/0.5/70 million units, and are expected to exceed 100 million units in 2021, with shipments increasing by 100.0%/92.3%/40.0%/42.9% year-on-year respectively.

1.4 Huawei, Xiaomi and other Android phone manufacturers are following up

Huawei has released two TWS true wireless Bluetooth headsets, FreeBuds and FreeBuds 2 Pro. Among them, Huawei FreeBuds 2 Pro is Huawei's first true wireless Bluetooth headset that supports the HWA standard. Huawei FreeBuds 2 pro not only supports Hi-Res Wireless Audio, but also supports wireless charging. At the same time, it also has the latest bone voiceprint unlocking technology, which can accurately obtain the bone voiceprint information of the owner when speaking. With AI artificial intelligence recognition technology, the owner's identity verification can be completed in one sentence.

Bone voiceprint ID makes payment easy. Take out the phone without unlocking and other operations. Just one sentence "Alipay Pay" or "WeChat Pay" and the QR code interface will open automatically. This headset has a talk time of up to 2.5 hours on a single charge. With the power stored in the charging box for multiple additional charges, the talk time can be up to 15 hours and listening to music can be up to 20 hours. In addition, the HUAWEI Mate 20 Pro mobile phone can give the headset box Reverse charging, easy to deal with emergency power supply when going out.

At the 2018 Xiaomi AloT Developer Conference, Xiaomi announced the Xiaomi special acoustic standard laboratory project. Products that meet Xiaomi's acoustic standards include Xiaoai speakers, Xiaomi mobile phones, Xiaomi laptops, and Xiaomi smart alarm clocks. In 2018, Xiaomi released its own two TWS true wireless Bluetooth headsets, Xiaomi True Wireless Bluetooth headset Air and Xiaomi Bluetooth headset AirDots Youth Edition.

The biggest feature of Mi Bluetooth Headset Air is that it supports active noise reduction, and the main and auxiliary ears can be switched freely and can be used independently. The Xiaomi Bluetooth headset AirDots Youth Edition uses an upgraded Bluetooth 5.0 connection, and both headsets support Xiao Ai's self-powered voice assistant.

2. Supply chain manufacturers involved in TWS headsets

AirPods is currently the strongest growing product among wireless headsets. We expect 2018E/2019E/2020E AirPods shipments to be 0.26/0.5/70 million units, and it is expected to exceed 100 million units in 2021, with shipments increasing by 100.0% respectively. 92.3%/40.0%/42.9%. Currently, only a small number of iPhone users are using AirPods, so AirPods shipments have huge room for growth. In addition, Android mobile phone manufacturers such as Huawei and Xiaomi are also actively deploying their own brand TWS wireless headsets to match their own mobile phones. The wireless headset market is expected to grow further.

The components of wireless headsets mainly include main control chips, memory chips, FPCs, voice acceleration sensors, MEMS, overcurrent protection ICs, batteries, etc. The A-share suppliers involved include Luxshare Precision, Zhaoyi Innovation, Weir shares, Goertek, Xinwangda, Pengding Holdings, etc., as well as some Taiwanese manufacturers such as Yaohua, Holley, etc.

Among them, Luxshare and Goertek are AirPods assemblers. Benefiting from better automated production lines, the AirPods business has become one of the company's growth drivers. Zhaoyi Innovation, as a supplier of NOR Flash, and Weir shares as a design and distribution manufacturer of discrete devices and passive components, will also benefit from the rise of the wireless headset market. Goertek and AAC occupy a leading position in the acoustic market and provide customers with overall technical solutions, which are expected to usher in new growth points. In addition, Pengding, Yaohua, and Huatong Suzhou FPC are the main suppliers of wireless headset FPC, and Hualijie is the exclusive VCSEL supplier for AirPods, which will also benefit from the strong growth momentum of AirPods.

1. Luxshare Precision: The initial assembly supplier of AirPods is Inventec from Taiwan, China. Goertek expects to introduce it in 18 years. The current production capacity and yield still need to be improved; Luxshare has introduced the supply chain in 17 years and has benefited from the advantages of production line automation. It is expected to fully benefit from the outbreak of AirPods.

The company started with connectors and continued to enrich its product line. The company began to introduce many new products such as LCP antennas, wireless charging, linear motors in 19, and we judged that the company’s new product yields exceeded expectations; in terms of acoustics, the company continued to expand the market share of acoustic components and vibration motors, actively improving technology and upgrading Product yield, and strive to narrow the distance with the industry leader. In addition, the company will continue to benefit from the continued increase and increase in the share of AirPods. The company has cooperated with major customers for many years, and its product technology and services have been recognized by customers, and its share is expected to continue to increase in the future.

The company has begun to make progress in the long-term business of communications and automobiles. The communications business has fully deployed wired, wireless and optical module businesses, and has made positive progress in several major overseas equipment customers. The 5G era is expected to grow new profits. In terms of optical modules, the base station side currently focuses on 6G/10G, and it is expected to gradually upgrade to 25G/100G in the future. The company's 5G base station filter products have already shipped some products in small batches. In the field of new energy vehicles, the company's new product line with domestic customers is progressing smoothly. As the volume of new energy vehicles continues to increase, domestic and foreign customers are gradually introducing them, which is expected to become a new growth driver.

2. Zhaoyi Innovation: The main business "storage + IoT" business has bucked the trend and made breakthroughs in product structure + new products. As a typical high-tech growth company, Zhaoyi has a growth path from NOR in 16 years to NAND in 17 years to DRAM in 18 years, and the market space will be opened tenfold. The company’s main business is gradually improving the layout of “storage-processing-sensing-transmission” around “storage + IoT”. Since 2005, new products have been continuously launched from SRAM→NOR→MCU→NAND. And this is exactly the essence that we have been emphasizing on high-quality technology companies' high-tech dividend conversion efficiency and outstanding growth. The company's core competitiveness lies in the optimization of product structure and cost reduction due to process iterations under strong execution. The company's high-end NOR Flash continued to increase in the fourth quarter, and SLC NAND further increased its volume. It is expected to continue to achieve steady growth.

Those who win DRAM win the world, and demand in three major areas drives DRAM to continue to grow. In 2017, the fourth silicon content increase cycle of global semiconductors started. The four core innovative applications of the Internet of Things, AI, smart driving and 5G will drive the exponential growth of data volume, which in turn will drive the global demand for memory, and the fourth silicon content increase cycle Inside, memory chips will become the main starting point to promote the upward trend of the semiconductor integrated circuit chip industry. The four core innovation drivers of the fourth wave of silicon content improvement cycle are AI, Internet of Things, 5G, and smart driving. From data generated by people to automatically generated by connected devices, data is growing exponentially! Intelligent driving and smart security perform data samples Training inference and the processing of sensing data by the Internet of Things have greatly stimulated memory performance and storage requirements.

The acquisition of Silic Micro has cut into AI human-computer interaction and created an integrated solution of "MCU-Storage-Interaction". Silimicro is a leading supplier of smart human-computer interaction solutions in the domestic market. Its products are based on new generation smart mobile terminal sensor SoC chips such as touch chips and fingerprint chips. This acquisition will help Zhaoyi enrich its chip product line, expand customer and supplier channels, and form a complete system solution as a whole. Shanghai Silimicro will supplement Zhaoyi's research and development technologies in sensors, signal processing, algorithms and human-computer interaction to a certain extent, and enhance its productization capabilities in related technical fields.

3. Weir shares: Outer M&A has grown rapidly, and Weir’s acquisition of Howe is progressing smoothly. Weir shares are acquiring Beijing Haowei. We expect the Securities Regulatory Commission to respond in February and it is highly likely that the acquisition will be completed in June. Howe is the world's third largest CIS manufacturer and has a solid position in the mobile phone market. It has entered Huawei, Xiaomi, OPPO, VIVO and other well-known manufacturers. In terms of products, the proportion of high-end CIS with more than 13 million pixels of Howe has gradually increased, and the company's product structure has further improved. In addition, Howe also has a layout in the security, automotive, AR/VR and other markets. Its LCOS technology has a huge market potential and provides high-resolution and low-cost solutions for the next generation of projection systems.

Howe will fully benefit from the high-growth CIS market. With the increase in the penetration rate of dual-camera and triple-camera, Howe’s share in various mobile phone manufacturers has increased. In the automotive field, BDO data shows Howe’s share of the automotive market is as high as 29%. With the rapid development of ADAS and autonomous driving, The market demand for the number of on-board cameras will increase substantially. In the security field, the company’s Nighthawk Nyxel technology improves the sensitivity of Howe’s image sensor to achieve clearer imaging under the same amount of near-infrared light and can detect farther imaging areas, reducing overall power consumption. The company has also made new breakthroughs in endoscopes in the medical field.

The company's business has grown steadily by combining self-research + distribution. With the recent recovery of power devices, MLCC inventory adjustment will come to an end. As a rare domestic company with semiconductor product design and distribution capabilities, Weir shares will fully benefit.

4. Goertek: Acoustic devices and MEMS are leading domestic manufacturers. Acoustic devices are continuously upgraded, adding stereo, waterproof, intelligent and other innovations. The company has advanced acoustic device design and production capabilities, and has a leading share among major customers. At the same time, the company continues to strengthen its layout in the field of microelectronics, with MEMS microphones and MEMS motion sensors occupying With a leading market position and increased investment in semiconductor chip R&D, packaging and testing, and SIP, it is expected to maintain sustained growth in the future.

With the rise of wireless Bluetooth headsets, Goertek has taken the lead in the layout of the TWS headset design and assembly and core acoustic components, occupying an absolute leading position in the market, and providing customers with overall technical solutions, which is expected to usher in new growth points.

5. Xinwangda: Extend to the upstream battery cell and deeply cultivate the battery field. At present, the company has become an industry leader in the field of batteries, and has blossomed in the field of consumer electronics. Cooperation with mainstream consumer electronics brands is also under discussion. At the same time, the company extends to the upstream cell industry, and in 18 years has reached 10% of the cells for self-production and self-use, the company's future costs will be seen to decline.

Started the field of new energy vehicle power batteries, and obtained certification from many manufacturers. The company has started the new energy vehicle power battery field, and has been certified by many manufacturers, and is also actively connecting with international customers. The company expects that the power battery business in 2019 will officially release benefits, supplemented by the company's optimism about the development of new energy vehicles in 2020, the company's yield rate has reached 90% in terms of products, and production will begin in 19, which will truly open the field of new energy vehicles .

6. Pengding Holdings: Refinement and automation help the company's profitability. As the leader of domestic and global FPC, Pengding implements refined internal management and automated production, helping the company to rise higher in profitability. At the same time, the company continues to expand production in the FPC field, helping the company to cope with the increasing demand in the FPC and PCB industries in the future.

Folding screens drive FPC usage, and the leading benefit is a trend. As Samsung and Huawei announce their foldable mobile phones, we foresee the future FPC usage will continue to increase in consumer electronics. According to our research in the industry, the FPC currently used in folding screen phones is about twice the usage of normal phones, that is, the current FPC usage of iPhone Xs is about 24 pieces, and the usage of corresponding folding screen phones will be close to 50 sheet. As a leader in the industry, we are firmly and continuously optimistic that the company will benefit from this technological innovation and the potential replacement wave of consumer electronics in the future.

With the establishment of companies in the FPC field, the company is currently actively deploying high-end product research and development and expanding into emerging fields. With the improvement of the current technological level, thin and light words are the development trend of various electronic products in the future, and the high-frequency FPC board using LCP technology and the deSLP board currently used by Apple are the two major directions used in the future downstream electronic products. As the industry leader in FPC, Pengding, we believe that he will benefit from the transfer of the PCB industry, and at the same time benefit from the development trend of FPC, further improve product technology to grasp market share and increase profitability.

7. In addition, some Taiwanese manufacturers such as Yaohua (AirPods soft and hard board supplier) and Hua Lijie (AirPods exclusive VCSEL supplier) will also benefit from the rise of the wireless headset market.

-

USB 4: Everything we know

2019-09-03 -

5G Changes the IoT Industry

2019-07-23 -

TWS Headset Market Analysis

2019-02-22